TRAC - The Collateral Management system supporting Structured Trade Commodity Finance

TRAC, A Trade Commodity Finance Collateral Management software for Banks:

TRAC is a middle/front office role-based application destined for Trade Commodity Finance Relationship Managers, Credit Risk Managers, and Top Managers who want to track and monitor theirs risks appropriately. The purpose of the software is to replace the Excel worksheet widely used in the Trade Commodity Finance sector.

More precisely, this new application covers:

- Transactional follow-up of portfolio of active Customers’ global economic position

- Monitoring of customer credit limits or/and groups of customers

- View of accounts' balance per customer and integration within margin calculation

- Collateral follow-up and management related to the lifecycle of a transaction

- Risk assessment and monitoring of these position

- Multiple purchases and sales per transaction

- Management of vessel information and control based on a bank’s specific standards

- Follow-up of storage facility per transaction with relevant location

- Built-in BI/reporting facility

- Multi-commodity application (Oil, metals, soft, etc…)

- Risk price monitoring “mark-to market” handling a combination of different prices (fixed, floating, hedge, alloy, complex formulas)

- Graphical chronometers per category of risk (eg storage inland, prefinancing, transit, B/L)

- Built-in workflow transaction approval system

- Dashboard view for management

- Warning management facility per customer (credit limits override, collateral due date expiry, documentation follow-up, margin management, etc…)

- Imaging capability (various formats covered such as jpeg, pdf, word, excel, etc..)

- Diary per transaction or customer’s position

- Price charts per commodity ,...

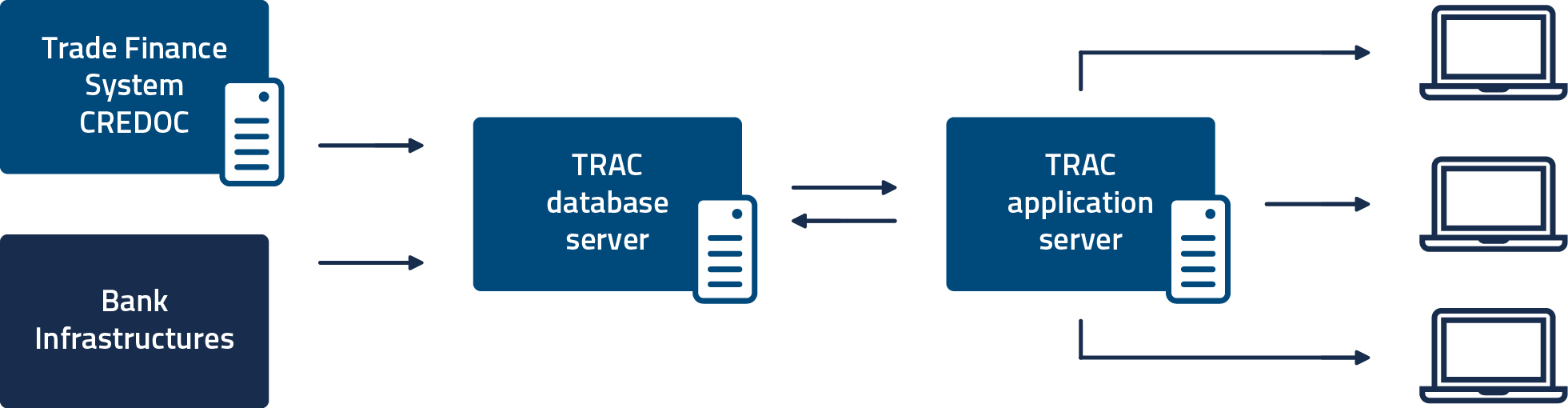

A few more details on our application: - J2E based application

- Multi-branch and multi-bank

- Solution can be hosted or installed in any type of organization

- Integration with any core banking system

- Integration with CREDOC or any other Trade Finance system handling traditional trade instruments including L/C’s, guarantees, collections…